Other recent blogs

Let's talk

Reach out, we'd love to hear from you!

Non-fungible tokens or NFTs reflect a paradigm shift in the digital era where we are still early in the adoption curve of Cryptocurrency and Blockchain. However, in a brief span of time, NFTs have gained massive popularity amongst entrepreneurs and creators who strive to establish their tomorrow’s revolutionary empires on mission-critical characteristics, including data integrity, security, validity, identity, and provenance.

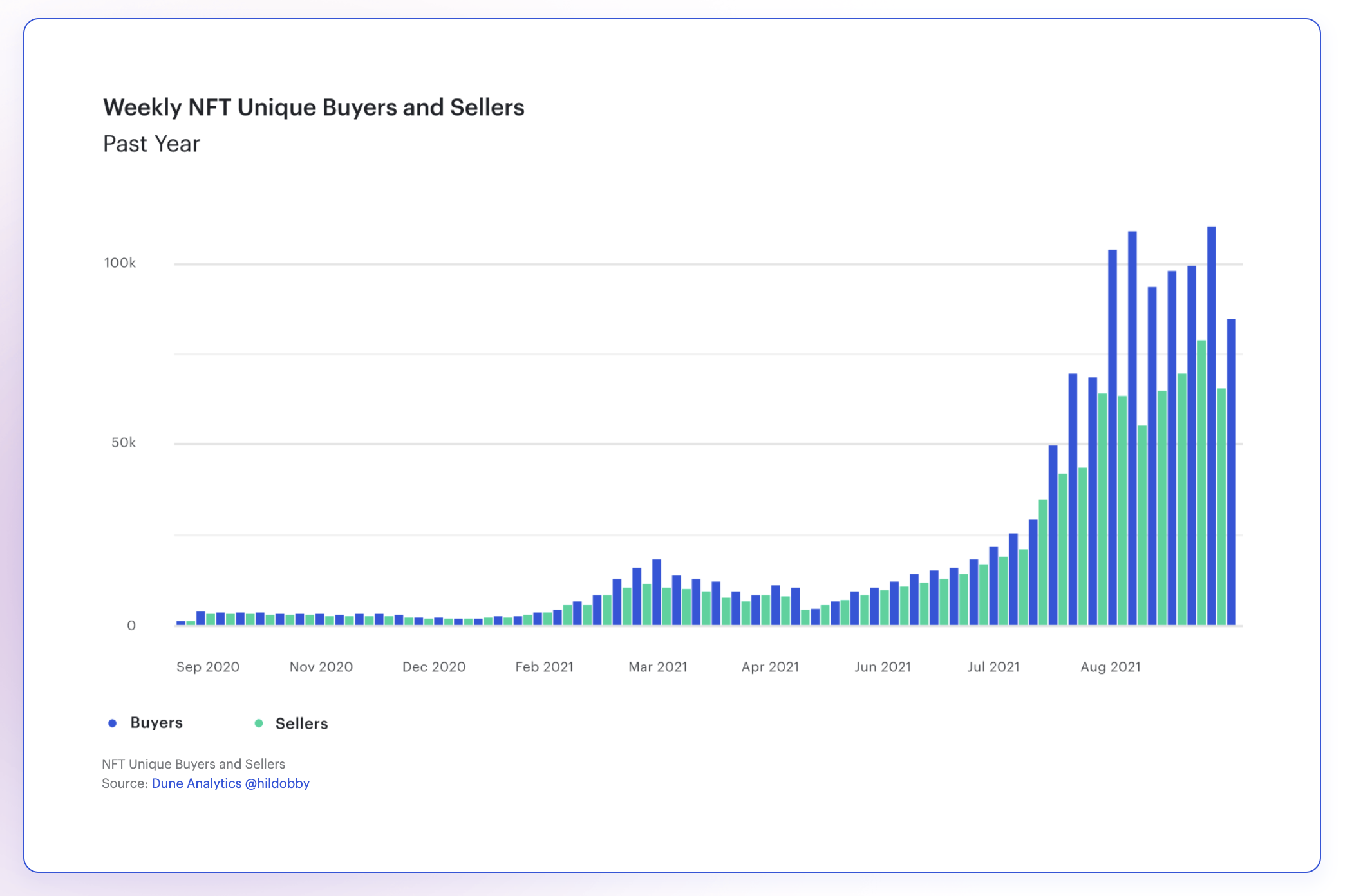

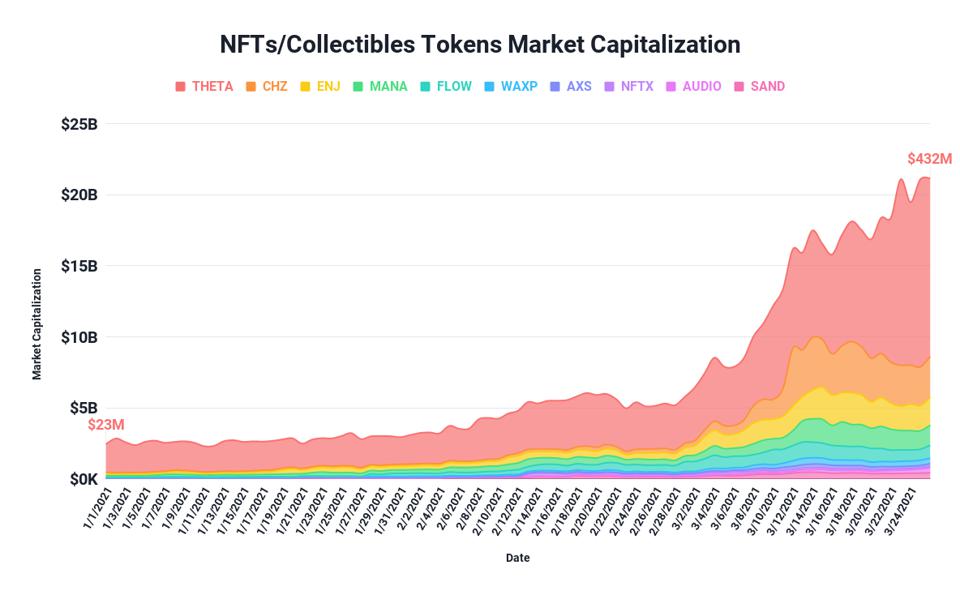

According to Forbes, the demand for NFTs is rapidly surging with no signs of slowing down. Presently, the growth of 1,785% has been witnessed in the combined market cap of NFTs projects in 2021. As a result, the NFT marketplaces, insurance, fractionalization, trading, and indices have become the most targeted segments for heavy investments across the various crypto and Blockchain ecosystems. And now they are going mainstream with an exponential $2.5 billion sales volume in the first half of 2021. This is how NFTs are pushing the digital frontier ever farther into the ether.

Source: Forbes

Decoding Non-Fungible Tokens: What does NFT mean?

NFTs stand for the unique cryptographically generated non-fungible tokens representing data stored on a digital ledger using the Blockchain technologies such as Ethereum, FLOW, Tezos, and Bitcoin Cash. They represent all kinds of digital collectibles like artworks, music, photos, video games, and audio in different digital formats, including GIFs, JPEG, and MP3.

The NFTs are traded digitally in exchange for cryptocurrencies. A buyer gains ownership of the original copy in the form of unique tokens but not the physical assets. Each NFT is entirely unique which means it cannot be replicated, or duplicated and is irreplaceable. Furthermore, the data stored in NFT majorly comprises the history of ownership, verification of ownership, and all transactions that happened./p>

A brief history of NFTs explained

The futuristic Non-Fungible Tokens have had a long history. The game-changing journey of NFTs started in 2012 with the emergence of Colored Coins. Built on the Bitcoin network, the Colored coins are originally conceptualized for issuing real-world assets like real estate on a blockchain as proof of ownership. It was the first existence of NFT that was used to represent many assets, including property, coupons, company shares, subscriptions, access tokens, digital collectibles, and more.

The inception of Colored Coins widened the growth horizons for NFTs and unlocked greater possibilities for experimentation. As a result, Counterparty was created in 2014. Founded by Robert Dermody, Adam Krellenstein, and Evan Wagner, Counterparty was a peer-to-peer financial platform/open-source online protocol that was developed using the Bitcoin blockchain. It was conceived from the idea of asset creation and a decentralized exchange without any possibility of counterfeiting. A trading card game and meme trading were the most common application areas of Counterparty.

Source: Counterparty

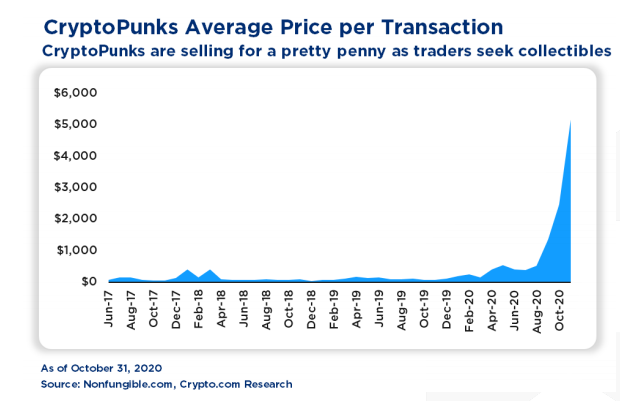

The excitement around Counterparty notably led to the development of many popular NFT collectibles games, including Spells of Genesis (in 2015), Force of Will - Trading Cards (in 2016) and Rare Pepes (in 2016) into the ecosystem. By early 2017, the new trends began to emerge after the rise of the Rare Pepe Meme Directory and given birth to Ethereum prominence. It was started when two technologists John Watkinson and Matt Hall generated unique 10,000 Cryptopunks using Ethereum Blockchain technology. A vast spike was noticed in the NFT marketplace when Cryptopunks were traded digitally.

Interestingly, the CryptoPunks hit the NFT Marketplace before the Ethereum Token Standard or ERC-721, and soon these non-fungible tokens paved the way for revolution for the ERC-721 standard. In October 2017, the most successful and well-known NFT project "CryptoKitties" created turmoil in the Ethereum Blockchain ecosystem after following the soaring popularity of Cryptopunks.

CryptoKitties can be explained as a virtual game primarily centered around breedable, collectible, and oh-so-adorable creatures. In this game, players can buy, breed, raise, and sell virtual cats having unique genomes. Reports estimate that over 1.5 million people are active players of CryptoKitties and generated $40 million worth of transactions.

As we entered into the multi-chain universe, the prominence of NFTs gradually exploded between 2018 and 2021. During early 2021, NFTs have become the primary source of disruption with platforms like Opensea, Mintable, Portion, and Niftex.

NFT vs Fungible Tokens: The key difference

The digital currency ecosystem got heated up in the past few years and has witnessed a massive influx of investments in Non-Fungible and Fungible tokens. Now, you might be wondering: what is the difference between fungible and non-fungible tokens? Let's begin with the basics:

Tokens: In the crypto landscape, tokens can be explained as a tangible or visible representation of a particular entity available for digital trade. A type of Blockchain virtual currency best recognized for its uniqueness, authenticity, and history of ownership. Tokens are categorized as:

- Fungible Tokens:The standard Blockchain digital assets are interchangeable within the same category of digital collectibles. Like any other form of cryptocurrencies, including Bitcoin, Ethereum, and MANA, an investor can exchange uniform Blockchain tokens for any other token. Such fungible tokens can be used as a medium of exchange in digital form. Fund transfers, settling trades, and voting are potential applications of fungible tokens.

- Non-Fungible Tokens: The unique Blockchain assets represent a specific asset with a particular value. They stand out as the digital certificates secured with Blockchain technology. Two NFTs can never be identical and cannot be traded as a medium for commercial transactions. NFTs are indivisible, and the data stored in the form of Non-Fungible tokens can never be removed. KYC procedures, loyalty programs, artworks, real-world assets, virtual assets, and copyright are some most relevant use cases of non-fungible tokens.

Source: Medium

NFT vs Cryptocurrency - The difference

As the name suggests itself, Cryptocurrency stands for a non-physical digital currency that is secured by cryptography and recorded on Blockchain technology. It is going mainstream because of the potential to store and the exponential growth quotient. Decentralization is a primary benefit of using Cryptocurrency, which means any governing authority cannot regulate it. To many investors, Cryptocurrencies look appealing as it is more secure than traditional payment systems.

ETH, XRP, Binance Coin, Tether, Cardano, Dogecoin, Polkadot, and Bitcoin Cash are the most common Cryptocurrencies available across the digital ecosystem. Many reports estimated that over 10,000 different cryptocurrencies are traded publicly, and the total value of different types of cryptocurrencies (as of August 18, 2021) was more than $1.9 trillion. There is no sign of a slowdown in the future.

Unlike Cryptocurrencies which are absolutely replaceable by any other identical fungible asset, the NFTs are new shiny digital assets that cannot be replicated, taken away, or destroyed. They reflect an individual characteristic and hold significant value. NFTs are powered by a cryptographic transaction process that ensures maximum authentication and proof of ownership of digital files stored that a buyer can transfer to a digital wallet. Despite running on the same technology, NFTs have become the front-runner for the future of art because of zero possibility to counterfeit the original artwork. NFTs are indeed a doorway to creating uniqueness and desirability.

Common applications of NFT

A radical growth has been witnessed in the tokenization of digital artworks by using Non-Fungible Tokens. Artists who desire to protect the authenticity and uniqueness of their paintings are now embracing NFT technology which eliminates any possibility of censorship, fraud, or interference from third parties. With NFTs, digital artists are able to have an art gallery in their pocket in a publicly accessible space.

Yes, digitally programmable artwork is one of the most common non-fungible token use cases to date. Given below are the most common examples of NFT-based artworks

Non-Fungible Tokens:Dreamy animations of Black life by Jazmine Boykins sold for more than $60,000.

Mike Winkelmann (Beeple) sold a single NFT for a record-setting $6.6 million and artwork ‘Everydays: The First 5000 Days' for $69 million at Christie’s auction.

An international DJ deadmau5 sold digitally animated stickers

Another segment where NFTs are creating turmoil is the legacy arts through the tokenization of real-world assets by harnessing the power of Blockchain and IoT. Furthermore, NFTs have played a crucial role and offered profound benefits in the industries including fashion, verifying licensing and certifications, collectibles (Opensea, BakerySwap, and Treasureland), decentralized finance (DeFi), micro-transactions and in-game purchases, music NFTs, as well as counterfeit tickets and merchandise.

The NFT ecosystem is still very young, but the popularity of NFTs growing at a rapid speed, unlocking the greater possibilities for crypto art and digital collectibles by verifying their authenticity and ownership digitally.

Want to build NFT marketplace, then connect with our expert's

Explore more in the NFT blog series:

Part 2: A detailed guide on NFT Marketplace where everything is explained about why the Blockchain-based NFT marketplaces are the most significant breakthrough and why they are expected to change the world.

Part 3: The future of Non-Fungible Tokens: 2021 and beyond talks about NFTs dominating the digital trading trends like cryptocurrencies and Blockchain